Asia

EMEA

2015-11-13

LANXESS raises guidance for 2015 again and presents new strategy

- EBITDA pre exceptionals for full year 2015 now expected between EUR 860 million and EUR 900 million

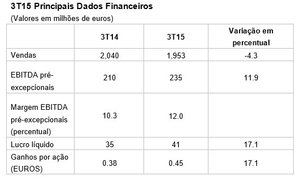

- EBITDA pre exceptionals in the third quarter 2015 improved by around 12 percent to EUR 235 million; net income up 17 percent to EUR 41 million

- Realignment of business being accelerated: Additional annual savings of EUR 150 million from the end of 2019 on to be achieved by optimizing plant network

- New strategic focus: Advanced Intermediates, Performance Chemicals and High Performance Materials to serve as platform for future growth

- EUR 60 million capital expenditure for Leverkusen site

- CEO Matthias Zachert: “LANXESS will become a more profitable and less cyclical specialty chemicals company with growth potential.”

Following a strong third quarter, specialty chemicals company LANXESS has continued to achieve solid business development, with its realignment plans progressing faster than expected. The Group is therefore raising its guidance again for the full year 2015 and now expects EBITDA pre exceptionals to come in between EUR 860 million and EUR 900 million. It had previously announced EBITDA pre exceptionals for the full year between EUR 840 million and EUR 880 million.

“Our business performance in the first nine months of 2015 was satisfactory,” said Matthias Zachert, Chairman of the Board of Management of LANXESS AG. “However, we also recognize that global economic growth is subdued and many emerging markets are marked by uncertainty. In view of this, we have once again picked up the pace of our realignment. This is already having an impact on our operating result and our guidance for the year.”

The effects of the improved administrative and business structures are already evident, with the company set to achieve annual savings of EUR 150 million following this first phase of the realignment already by the end of 2015, one year earlier than expected.

LANXESS is also accelerating the second phase of its realignment program. From the optimization of its global plant network, the Group anticipates additional annual savings of EUR 150 million. These will be achieved progressively over the coming years and will be fully realized by 2019; roughly EUR 10 million of this already in 2015. The additional expected savings result from a global analysis of the company’s plants and processes. This analysis will extend into 2016. Roughly EUR 100 million of this figure is expected to be generated through a comprehensive package of process improvements at production sites, resulting, among other efficiencies, in lower consumption of energy and raw materials and in optimized maintenance processes. Capacity adjustments and efficiency measures at rubber production facilities in Latin America and France will contribute up to EUR 30 million in savings. The reorganization of the production network for ethylene propylene diene monomer (EPDM) and neodymium-based butadiene rubber (Nd-BR), announced previously, will result in further savings of EUR 20 million.

New strategic focus: Profitable growth in mid-sized markets

Through its rapid realignment and, in particular, the agreement with Saudi Aramco on the creation of a joint venture for synthetic rubber, LANXESS has established the basis for its new strategic focus. “Now that we have solved the main structural problems, we can once again concentrate on growth,” said Zachert. “LANXESS will be a more profitable and less cyclical specialty chemicals company – with a balanced portfolio of quality products and with growth potential.”

The company has already defined its strategic cornerstones for future growth and will focus on mid-sized markets. Its new growth platform includes the businesses with chemical intermediates and additives, agrochemicals, color pigments and high-tech plastics, as well as specialty chemicals for water treatment, material protection and the leather industry.

“In these businesses, we have leading positions in diversified, less cyclical markets, which we plan to expand,” explained Zachert. “We will thus be able to increase our profitability and simultaneously become more resistant to cyclical fluctuations.” In particular, LANXESS sees China, North America and Southeast Asia as major growth regions.

The company is also planning to expand its cutting-edge plant network and to move ahead with the integration of its value chains. To achieve this, LANXESS intends to invest up to EUR 400 million in growth projects by 2020. This is part of the proceeds that the company will realize from concluding the joint venture for synthetic rubber.

First investment as part of the realignment: Expanding the Leverkusen site

LANXESS has decided to expand production of its Saltigo business unit at the site in Leverkusen and is investing EUR 60 million there to build two new production lines, primarily for agrochemicals. Construction is scheduled to begin in the middle of next year, while production should start at the end of 2017. “Our ‘Verbund’ sites in Germany will remain a major contributor to LANXESS’ success in the future, and this is clearly underlined by our first major investment as part of the realignment,” said Zachert.

Operating performance: Strong third quarter 2015

Sales in the third quarter of 2015, at EUR 1.953 billion, fell slightly, down 4.3 percent compared with the strong prior-year quarter. This development was largely attributable to selling price adjustments owing to lower raw material costs. In contrast, EBITDA pre exceptionals increased by 11.9 percent to EUR 235 million, primarily due to the strong U.S. dollar and savings from the realignment program. The EBITDA margin pre exceptionals improved accordingly to 12.0 percent, compared with 10.3 percent in the prior-year period. All three segments contributed to the earnings increase. Net income rose by 17.1 percent to EUR 41 million in the reporting period, against EUR 35 million in the prior-year quarter.

Net financial liabilities decreased slightly to EUR 1.323 billion, against EUR 1.336 billion at the end of 2014.

Business trends by segment

Sales in the Performance Polymers segment declined year-on-year by 6.6 percent from EUR 1.045 billion to EUR 976 million. Despite the persistently difficult competitive environment, slightly higher volumes, favorable currency effects and savings from the realignment program led to a year-on-year improvement of the operating result. EBITDA pre exceptionals for the segment advanced by a substantial

35.5 percent to EUR 126 million.

In the Advanced Intermediates segment, sales decreased by

7.6 percent from EUR 476 million to EUR 440 million. EBITDA pre exceptionals for the segment increased 1.3 percent year-on-year to EUR 76 million as a result of positive currency effects and savings from the realignment.

Sales in the Performance Chemicals segment increased by

2.9 percent from EUR 509 million to EUR 524 million. While selling prices remained virtually unchanged, positive currency effects more than offset lower volumes. EBITDA pre exceptionals rose considerably by 14.7 percent to EUR 86 million, primarily due to the strong U.S. dollar and cost savings.

LANXESS is a leading specialty chemicals company with sales of EUR 8.0 billion in 2014 and about 16,300 employees in 29 countries. The company is currently represented at 52 production sites worldwide. The core business of LANXESS is the development, manufacturing and marketing of plastics, rubber, intermediates and specialty chemicals. LANXESS is a member of the leading sustainability indices Dow Jones Sustainability Index (DJSI World) and FTSE4Good.

Cologne, November 5, 2015

idr (2015-00054e)

Forward-Looking Statements.

This news release may contain forward-looking statements based on current assumptions and forecasts made by LANXESS AG management. Various known and unknown risks, uncertainties and other factors could lead to material differences between the actual future results, financial situation, development or performance of the company and the estimates given here. The company assumes no liability whatsoever to update these forward-looking statements or to conform them to future events or developments.

Information for editors:

All LANXESS news releases and their accompanying photos can be found at press.lanxess.com. Recent photos of the Board of Management and other LANXESS image material are available at photos.lanxess.com. TV footage can be found at globe360.net/broadcast.lanxess/.